GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Every self-employed person in the UK knows this feeling: the HMRC Self Assessment UK deadline is creeping closer, and your inbox is already filling up with reminders to “file on time” or face penalties. Maybe you’ve started pulling together invoices and receipts. Maybe you haven’t touched a thing. Either way, you’re not alone; millions of small business owners, freelancers, and landlords face the same tax-time pressure every year.

At Aone Outsourcing Solutions, we understand that your time is better spent running your business than trying to decode tax codes, reconcile spreadsheets, or worry about penalties. That’s why we offer reliable, accurate, and fully managed Self Assessment tax return services so you can stay HMRC-compliant without lifting a finger.

Whether this is your first year as a sole trader or you’re filing multiple income streams across contracts, properties, and investments, Aone Outsoourcing Solutions is here to make tax filing clear, compliant, and completely stress-free.

In the UK, Self-Assessment tax return filing is the process by which individuals report their income to HMRC when it isn’t automatically taxed through PAYE (Pay As You Earn). If you're self-employed or receive income outside of a regular job (like rental income, freelance work, dividends, or overseas earnings), you're required to submit a Self-Assessment tax form each year.

Your responsibilities under HMRC tax self assessment include:

Register with HMRC

Track your income and expenses

Calculate how much tax you owe

Submit your tax return by the legal deadline

Pay the correct tax (and National Insurance)

It’s your responsibility to get it right, even if HMRC hasn’t contacted you directly. Mistakes or delays can lead to fines, interest, or investigations.

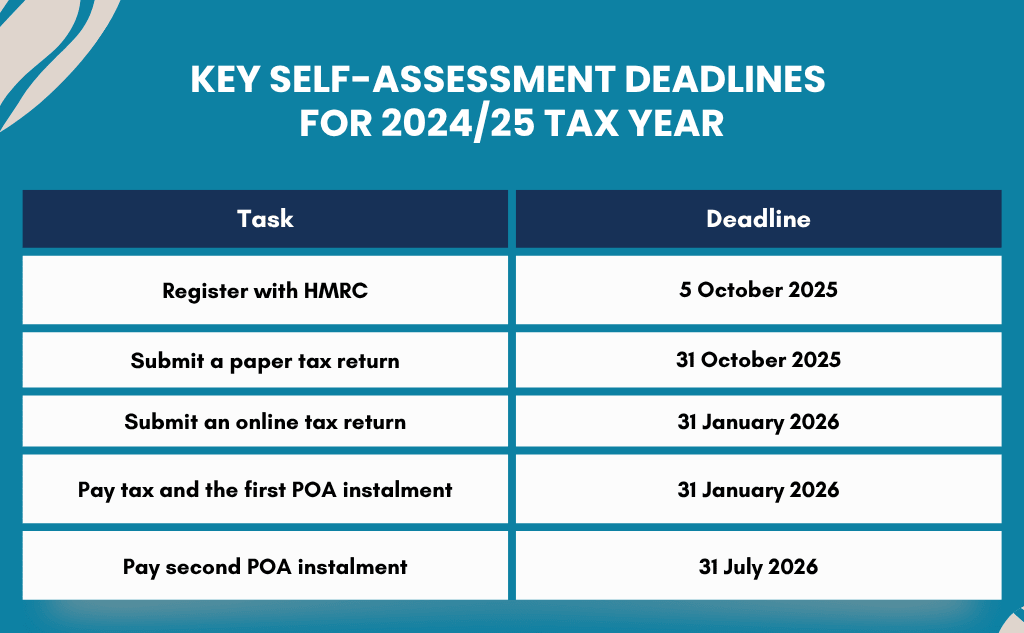

The Self Assessment tax year runs from 6 April to 5 April the following year. Most people must file their Self-Assessment tax return in the UK and pay any tax owed by 31 January, when both the tax return and payment are due (for online submissions). If you’re filing on paper, the deadline is 31 October.

You’re legally required to file a Self-Assessment tax return if you:

Are a sole trader earning more than £1,000 per year

Run a partnership

Receive rental income as a landlord

Earn freelance or contract income

Get income from investments, dividends, or crypto

Have income from overseas sources

Claim certain tax reliefs (e.g., for pensions or charitable donations)

Need to report capital gains

If any of these apply and you haven’t yet register with HMRC for a UTR, Aone can help you do that too.

Missing these deadlines results in immediate penalties and growing interest, which is why timely, professional help matters.

Missing these deadlines results in immediate penalties and growing interest, which is why timely, professional help matters.

At Aone Outsourcing Solutions, we offer a comprehensive suite of end-to-end Self-Assessment tax return services that make your Self-Assessment tax return filing fast, accurate, and fully compliant with HMRC regulations. Whether you’re a sole trader, freelancer, landlord, or small business owner, our expert self-assessment tax return accountants will guide you through every step—from registration to submission and beyond.

Here’s what we include in our Self Assessment services:

1. Self-Assessment Registration & UTR Setup

If you're filing a tax return for the first time, we’ll help you register with HMRC and get your Unique Taxpayer Reference (UTR), a requirement for all self-employed individuals. We’ll also make sure your HMRC account is set up correctly so you can access and track your tax returns online.

2. Income & Expense Analysis

We carefully review and organise all sources of income, whether from self-employment, property, investments, or overseas. We also help you track and categorise allowable expenses, ensuring nothing is missed and everything is claimed correctly to lower your tax liability.

3. Complete Tax Return Preparation & Online Filing

Our expert accountants prepare and file your Self-Assessment tax return online with 100% accuracy. We ensure all entries are fully compliant with HMRC guidelines and submitted well before the deadline, giving you total peace of mind.

4. Payment on Account Calculation & Planning

We’ll calculate whether you need to make Payments on Accounts and help you plan your cash flow accordingly. If your earnings are down this year, we can also apply to reduce your advance tax payments to avoid overpaying HMRC.

Missed a deadline or received a penalty letter from HMRC? Don’t worry—we can help you submit late returns, appeal penalties (where applicable), and deal directly with HMRC to get your tax affairs back on track.

We act as your point of contact for all HMRC communications. Whether it’s a tax notice, a request for more information, or a compliance check, we deal with HMRC on your behalf, so you don’t have to.

Unlike one-time tax advisors, Aone is with you all year long. We offer support before, during, and after tax season—whether you need help budgeting for future tax bills, reviewing income changes, or preparing for next year’s return.

8. Digital Recordkeeping & Software Support

We help you stay organised with digital recordkeeping tools and accounting software. Whether you're using Xero, QuickBooks, FreeAgent, or another platform, we integrate your records into our process for smoother, faster tax filing.

At Aone Outsourcing Solutions, we don’t just “do your tax return.” We provide complete end-to-end support, combining expert knowledge with hands-on service that saves you time, reduces your tax liability, and ensures 100% compliance.

From initial registration with HMRC to final submission and payment reminders, Aone takes care of the full process. Whether it’s your first return or your tenth, we’ll:

Set up your HMRC account and obtain your UTR

Collect and organise all your income and expenses

Ensure you claim every allowable deduction (legally)

Calculate your tax due and any payments on account

Submit your return accurately and ahead of deadlines

Notify you when and how much to pay to HMRC

This means no confusion, no missed deadlines, and no tax surprises.

Too many self-employed people overpay tax simply because they don’t know what expenses they can claim. We’ll identify all allowable business costs, including:

Travel and mileage

Home office expenses

Equipment, software, and tools

Insurance, utilities, and professional fees

Marketing, training, and more

Our accountants know the tax rules inside out—and we apply them to reduce your tax bill wherever possible.

3. We Manage Payment on Account Calculations

If your tax bill exceeds £1,000, HMRC expects advance payments for the following year (known as Payments on Account). These are split into two instalments and can come as a shock if you’re not prepared.

We help you understand and budget for these payments, so you avoid cash flow issues, and we make sure you don’t overpay unnecessarily, especially if your income has dropped.

When you work with Aone, you never have to worry about missing a due date again. We maintain a personalised tax calendar for your business and send timely alerts and reminders for:

Upcoming filing deadlines

Payment schedules

Any HMRC correspondence

Even if you’ve missed a deadline in the past, we can help you submit late returns, mitigate penalties, and get back on track.

Received a letter from HMRC that doesn’t make sense? Been asked to provide more information or amend a previous return? We act on your behalf, communicate directly with HMRC, and ensure your position is clearly and accurately represented.

You don’t have to deal with any of it alone. We will help you with all the self assessment hurdles that come across you.

Managing your Self-Assessment tax return UK can be a daunting and time-consuming process. Between tracking income, claiming expenses, keeping up with Self-Assessment tax dates, and ensuring compliance with HMRC tax return online requirements — it’s easy to feel overwhelmed.

That’s where Aone Outsourcing Solutions steps in. Our professional team will fill Self-Assessment tax return for you, liaise with HMRC, and give you total peace of mind that your tax affairs are up to date, accurate, and fully compliant — so you can get back to running and growing your business.

So Are you ready to make tax season easy? Contact us today for a free consultation and take advantage of our one-month free trial on all Self-Assessment tax return filing services!

The deadline for online submissions of your tax return self-assessment UK is 31 January after the tax year ends.

If your self-employed earnings were under £1,000, you might not need to register for self-assessment — but other income types may require filing. Speak to us to check your status.

You can pay online by debit card, BACS, or set up a Direct Debit. HMRC must receive the money by 31 January.

You’ll face an immediate £100 penalty and potentially more fines the longer you delay. Aone can help you file ASAP and minimise these penalties.

Yes — we can register you for self-assessment, prepare outstanding tax returns, submit them to HMRC, and work to reduce any penalties or interest.

.png)

BUSINESS SERVED WORLDWIDE

STAFF

SERVICE RATING

INTERNATIONAL CLIENTS

CENTERS/BRANCHES